News & Updates

-

Deutsch-Schwedischen Handelskammer

"If I am selling to you, I speak your language. If I am buying, dann müssen sie Deutsch sprechen”

– Willy Brandt -

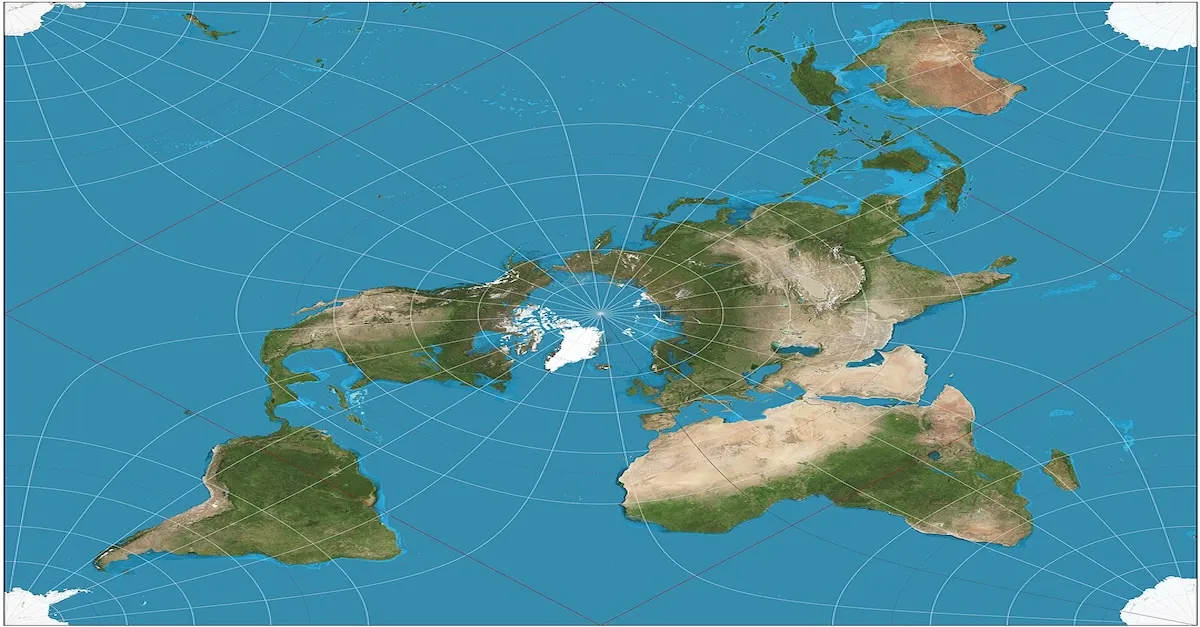

Set sail

Sometimes, all it takes is a new perspective to see opportunities differently.

Navigating the future of alternatives will require new perspectives — and open minds willing to explore new markets. -

Alpha Alternative Beta Exploration

Alpha Alternative Beta ExplorationEurope: A strategic overweight?

Reconsidering?

-

Blogpost

BlogpostCombining expertise, client focus and deep market understanding

Our mission is simple yet vital: to bridge the financing gap in the highly complex world of alternative strategies.

-

Investment Alpha

Investment AlphaWhat are you harvesting?

In global markets, the strongest returns belong to those who plant with intention — and wait with conviction. In an environment driven by speed, transparency and data - the real advantage belongs to those who invest accept illiquidity and invest with patience.

-

Conference Blog

Conference BlogPack your badges: It's AGM Season

From Risk & Return in Stockholm, Opportunity amid Volatility in Frankfurt to Prvate Credit & Loan markets in Focus in Madrid

STOCKHOLM:

FRANKFURT:

MADRID: -

Impact investing

Impact investingEmerging Infrastructure Debt financing - risk characteristics

If the risk characteristics of Private Debt suit your investment style,

then project finance debt financing in Emerging Markets could be your next great find. -

Investment

InvestmentIf secondary markets captivate you, risk transfer will too.

Explore the unique landscape of Insurance Assets.

Our esoteric alternative strategies stand apart from conventional markets, ensuring higher cashflows and superior liquidity. -

European Venture - new season, new vision

Investing in green tech is not just an environmental decision—it’s a strategic, cost-effective, and future-proof investment that ensures long-term growth, competitiveness, and sustainability.

-

Alternative Beta Exploration

Alternative Beta ExplorationEsoteric investment strategies

Uncorrelated and non-traditional asset portfolios