WEBINAR

From low risk long dated cashflow with fixed income like and real estate characteristics to higher yielding and higher leveraged greenfield developments.I will be posing the following five key questions to the experts at Palladio Partners to uncover critical insights and trends in German infrastructure investing:

1 German Economy?

Is Germany's economic engine losing steam, or just shifting gear to power ahead?

2 Key Political Trends?

What are the key mega trends shaping growth opportunities in Germany, one year before the German elections?

3 Sector-specific Opportunities?

What is the status and outlook for renewable energy power generation, grid & transmission of electricity and heat, digitalization, transport, and more?

4 Executing Infrastructure Projects?

What are the essentials for successfully executing investments in Germany? What distinguishes the German infrastructure market compared to North America, Australia, UK, France, and other European countries?

5 Accessing Opportunities?

How can international investors tap into attractive opportunities in Germany's infrastructure?

Extra

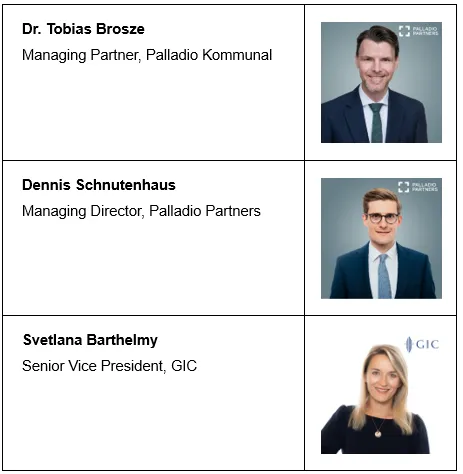

I am very pleased to say that we will also be joined by a speaker from GIC, a leading global investment firm, about their experience and insights on why and how they invest in Germany. This firsthand account will provide valuable perspectives and practical advice.

MEET THE EXPERTS

Palladio Partners is a premier investment manager in Germany specializing in Infrastructure and Private Equity. Founded in 2012, Palladio Partners is an owner-managed investment boutique with over 80 professionals managing more than EUR 9 billion in assets.